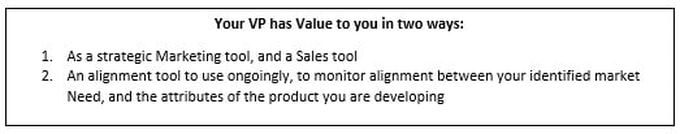

Much has been written at a helpful level on the concept of the Value Proposition (VP) – easy to find on Google, and I have no intention to repeat or compete with that material. Rather, my goal is to provide readers with information that will be helpful as you consider the issues around constructing a VP. What does a VP look like? If this is new to you, you might ask – what does a VP look like? Expressed in a short, succinct sentence or two, the VP states what a stakeholder can expect to receive in return for what they gave. Do I really Need a Value Proposition? Many products have been created and commercialized without the guidance of a Value Proposition, and for these, it might be well rewarding in increased future revenues to go back and retroactively create VPs as necessary. Creating a VP for a product under development seems a no-brainer in terms of strategically guiding its development to put the product into the sweet spot in its marketplace. There are many examples to be found on Google - look there for ideas. If carefully crafted, you will be able to use the same VP for different stakeholders; this depends strongly on your application/market/needs. Your product’s VP could be the same as you company’s VP, but either way, they should each be crafted to be used as one of your key promo/selling tools. You should know the sales stories of your competition and keep them in mind as you craft yours. A hard fact Is that if your product bombs commercially, you won’t be benefitting anyone, so you might have to de-emphasize patient facing value in VPs in favor of attributes that decrease costs or increase revenue. Create Multi-use Value Propositions VPs could be tailored to be used in your Pitch Decks / Pitch Books for each category of stakeholder. The VP as expressed to each of these stakeholders could be different unless you are able to express it broadly, then you could group some of them, and use them with other, supporting materials to make your pitch to individuals:

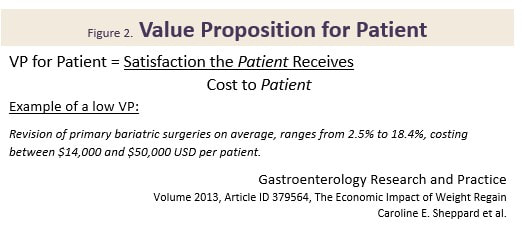

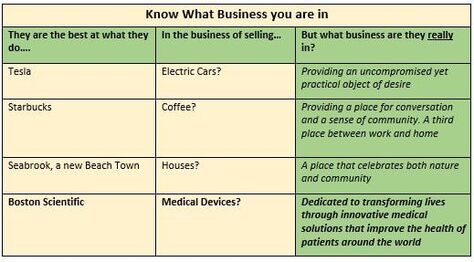

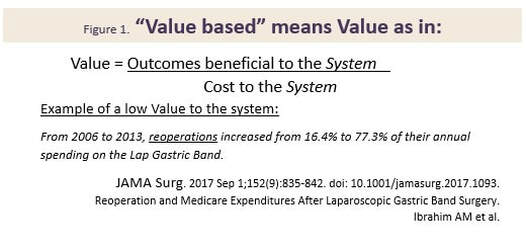

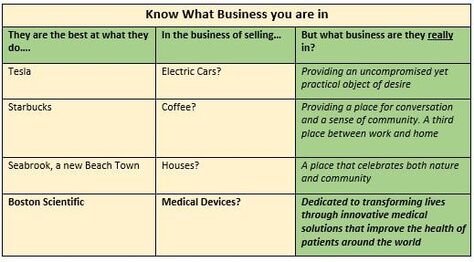

Hot Button Selling? Sounds like Hot Button Selling, you say? Well, not really. The difference being that hot buttons usually are discovered by the sales force while in the trenches, and then are used to close an individual sale. A VP in contrast should have been created, developed and nurtured well beforehand, and provided to the sales force as part of their training and armamentarium. A well expressed VP very likely will help the prospect to vocalize their hot buttons, and will play into and support your classic Feature-Benefit presentation and close. At the same time, the VP should encompass the core mission of the company, noting however that the VP is usually worded differently to the Mission Statement. Value Based Selling Your VP(s) should be crafted to show how well your product supports the Value Based model, where the Prospect makes their purchasing decisions based on being able to clearly quantify the value in their purchase. If you plan to sell to larger institutions, your VPs will have to successfully address a gauntlet of Committees beginning with Value Analysis and Technology assessment. Be alert that the same-named committee at a different institution could have different pain-points and stressors that you will have to discover and work through. Paradoxically, a weak VP for some of your stakeholders need not spell immediate doom for your product. Figure 1 shows how a low VP for a device can impact the System. Figure two shows how a low VP for a surgical method can impact Patients. In both cases, this would appear to illustrate how a device or method with a weak VP for two of its stakeholders (the System and the Patient), can cling to its commercial life, presumably buoyed by a strong VP for surgeons and other stakeholders.  Know What Business You Are In In creating your VP(s) it is a good idea to first figure out “what business you are in” – you might be surprised at the results. The Table below shows how some well-known companies position themselves.  "Feature Creep" Finally, if you are writing a VP for a product under development, your VP is a ready-made tool to monitor and correct for "feature creep" during product development and eventual transfer to manufacturing. Assuming that your VP reflects the marketplace Needs that you intent to satisfy, you can use it to monitor and timely correct for slippage and creep in the product under development. As a Medical Device Manufacturer, the development of your product is/will be subject to the FDA's Design and Document Controls under their Quality System regulations. As such, the project will be subject to regular, formal reviews, and this is the most convenient place to regularly review the VP and product for alignment. Strategizing, crafting, maintaining VP statements is simple, but not easy – so whether you are experienced, or new in this business, now would be a good time to reach out to the experts at BizPush and MedSurgPI for a no-commitment exploratory discussion. Contact Us! Suggested additional reading Creating and Delivering Your Value Proposition (Managing Customer Experience for Profit) Barnes, Blake, Pinder; Kogan Page Publishers. ISBN 9780749458591.

In the excitement of conceiving your killer ap, you instinctively want to “build a prototype” so that you can show it around to possible investors and partners. Or you want to build a prototype to see if your idea will work. You will eventually have to do both of those activities if your product will have a physical embodiment, (as opposed to software or pharma for example, where the analogous “prototype” would likely be a written description, and not need a physical model to be constructed). A note for developers working in the digital device realm - most of this article will also be applicable to your activities; one important additional one being the need for additional fail-safe considerations for the patient. In your software or firmware controlled device under development, it could take a skilled "forensic" engineer tease out all the possible failure modes. The Three Pillars of Risk To succeed at your product development project, you will have to overcome the three pillars of risk:

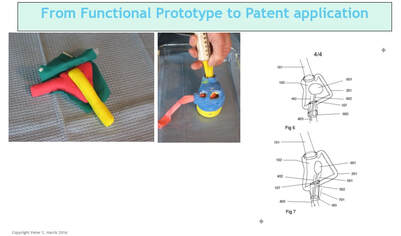

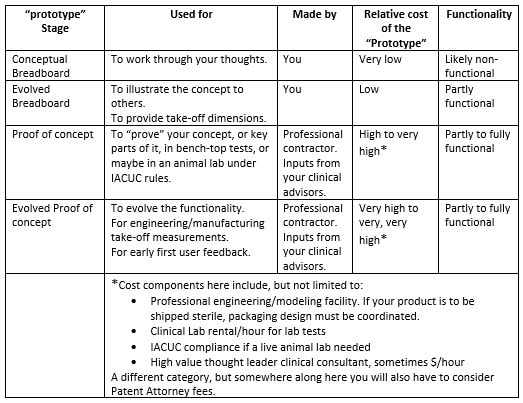

In discussion with a leading Product Development associate, we are reminded how complex each of these areas are, with Technology often being "easier" for a particular project than the latter two. Their advice? Focus on quantifying Market and Regulatory risk before getting too far into product development. This can be contrary to the instinct of inventors and engineers who typically focus on Technology issues while ignoring the many lurking deal breakers in the Regulatory and Marketing arenas. Take a Step Back So, before you contract with a professional to engineer and build your prototype, you will likely be better served by taking a step back and considering what you really need at this stage, and what the returns on your dollars invested will be. The goals here being that you want to map out the most efficient use of your starter/seed funds, and also to be able to go to your professional model builder with a clearly defined description/scope of work for your prototype needs. Firstly though, it’s important to understand that there are different kinds of prototypes, built for different purposes. In your application, prototypes might represent the progressing evolution of your thinking. Or they might be just a subsection of the whole, intended for example to help assess your Value Proposition. Or, to enable your eventual professional model builder, or your IP counsel, to better understand some aspect as they prepare their diagrams. What is the purpose (or "Stage" of your proposed prototype?) In this table I illustrate roughly the purposes for which a prototype might be built. Any one of these "stages" could also be a point where, if this is your strategy, you could dress up your idea to sell it, or to seriously look for funding or to look for partner(s). Real-world examples of different Stage prototypes  Image 1 shows a real-word prototype, as was used to illustrate its subject concept, and to provide guidance in the preparation of patent drawings and claims. Simple, effective, and necessary. Other prototype versions were built to model functionality.  Image 2 shows a real-world “breadboard” prototype, used to provide take-off dimensions - in this case, for mechanical components. It would be similar for a for a device comprising electronic components such as switches, cables, plugs, processors etc. Electrical and mechanical functionality were demonstrated on a different model.  Image 3 shows a real-world “proof of concept”, using a professionally engineered and built prototype, in an animal lab. This requires significant preparation and expense including recruiting and training a qualified surgeon (unless you are one), acquiring a suitable animal model, and renting OR and RR space, and compliance with extensive IRB and IACUC rules governing the care of the the animal subject. This lab was done in order to verify the in vivo functionality of the end effector of the subject device. To be clear – none of the challenges mentioned should deter you – this is simply the Medical Device landscape in which you have chosen to operate.

Suggested next steps Roughly in priority order, and most of which will require some level of funding from your seed funds:

Now you can go back to your Medical Device Modeler Once you have accumulated enough GO flags, you can go back to your Medical Device Modeler and discuss your prototyping needs with confidence and credibility. A Heads Up Don't underestimate early attention and seed funding needed (if you are not already set up and seasoned in this field) for the formal documentation of your R&D efforts on your device concept. It is beyond the scope of this article other than to give you a heads-up to become familiar with the main documentation requirements of the FDA, such as for starters: Design History File; Device Master Record; Device History Record; FDA Design Controls 21 CFR Part 820.30.The FDA can be quite severe in penalizing for transgressions, and my advice is to embrace the guidelines for the good they do and to never try to circumvent them - it is not worth it. So whether you are experienced, or new in this business, now would be a good time to reach out to the experts at BizPush and MedSurgPI for a no-commitment exploratory discussion. Contact us! Your Market Assessment will eventually drive your Marketing Plan, which will feed into your Business Case Assessment and Business Plan. At the end of your Market Assessment exercise for your new product, you should have a credible handle on each of the Issues listed, and be able to abstract them into your Pitch Deck. This article will take a top-level look at each Issue. How deep you dive into each item is up to you and and depends on how convincing you need to be to investors and other stakeholders. 1. What business are you really in? 2. Are you in a demand-pull or a technology-push market? 3. Are you in a Linear, Long Tail or Bubble market? 4. Attributes of your End User 5. How well your product concept aligns with your Target Market 6. Total world-wide/or country-wide market size and growth projections 7. Projected Weighted Actual Market 8. Projected Market share 9. Projected EBITDA Leading to your conclusion --- a credible GO or NO-GO? Issue 1 What Business am I in The table below might surprise you, and have you rethink your product positioning statements. Issue 2 Demand-pull or a Technology-push market Your market assessment exercise should tell you whether your idea is a Demand-pull, (that's ideally where you want it to be) or if you are in reality Pushing your product into a market where the Need is only, or mostly, in your dreams. Note that I'm NOT saying to stay away from Product Push, but just that you should understand what you are dealing with. Great to be excited about your idea, but this is the time for you to balance your excitement with some level-headed discovery and assessment of the Need for it. In other words, is the Need that you think you have found one of demand in the market, where you can have some profitable fun, or is your enthusiasm luring you into a product push situation where you will be forever trying to convince customers to buy. Issue 3 Your market's characteristic profile

Issue 4 Attributes of your End Users

Issue 5 How well your product concept aligns with your Target Market

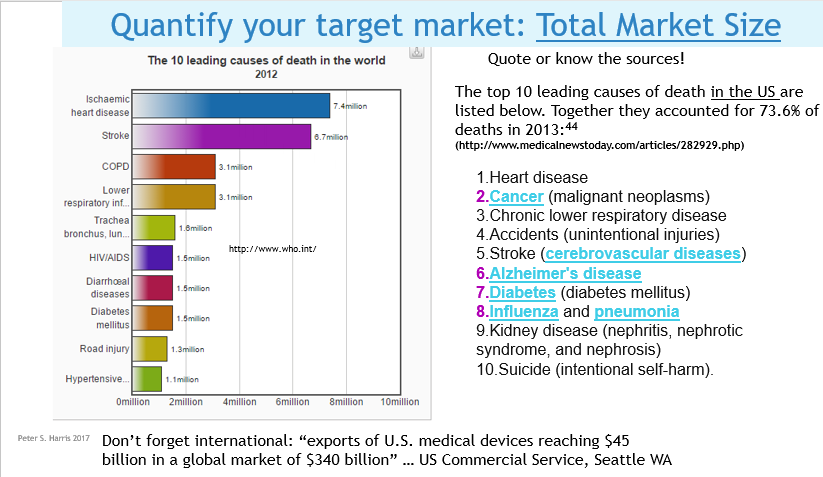

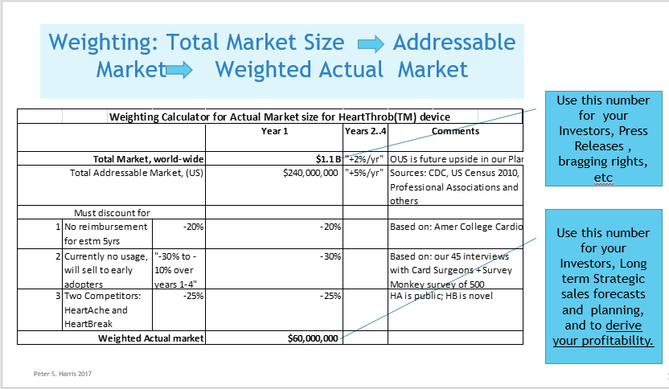

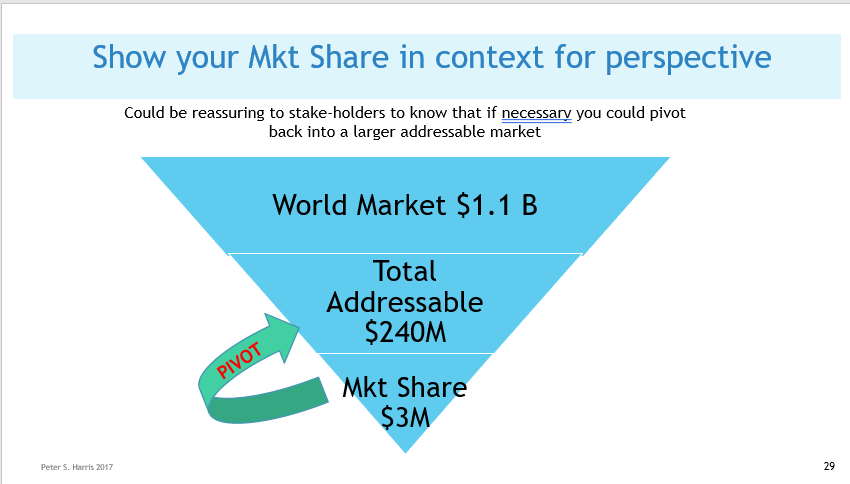

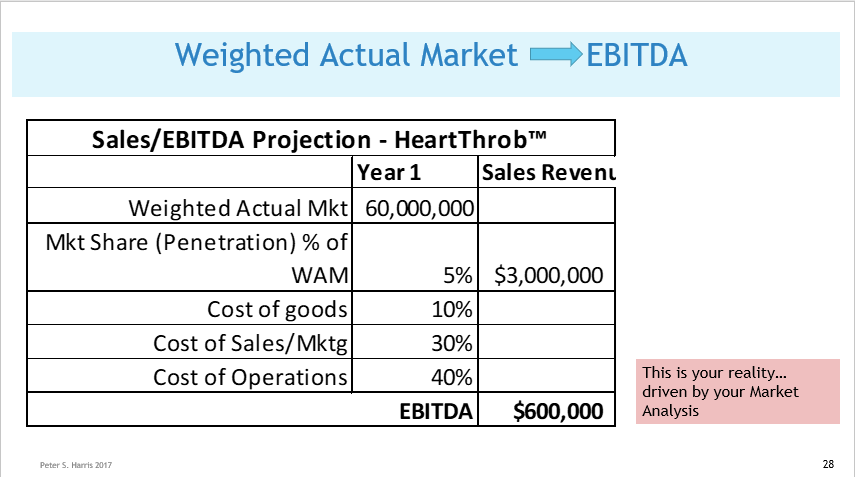

Issue 6 Know the total world-wide/or your country-wide market size and growth projections. No matter your application, there will likely be several credible sources of usage and demand data, that you can apply directly, or extrapolate to create your demand, sales volume and revenue projections. The two most commonly available diagnostic codes in the US (CPT and ICD) provide usage data at the granular level. The AMA's (Current Procedural Terminology) code describe tests, surgeries, and other medical procedures. Medicare (CMS)'s ICD Codes are used globally to track health statistics and causes of death. The many professional societies such as the AMA, ASMBS, provide open source data in presentation friendly chart format. (As always, be careful to avoid copyright infringement, and to attribute your sources. Noting that even if the information is made available open source, the owner might still require attribution if you use it in print or electronically). Doing Surveys and Focus Groups can add valuable data and insights to your projections.  Issue 7 Projected Weighted Actual Market  Issue 8 Your Projected Market Share  Issue 9 Projected EBITDA Next Steps

If, after working through these issues, you decide on a “Cautious GO”, the next logical steps would be to develop a Business Case Assessment that includes Risk evaluation, Regulatory and and other issues. These would support your upcoming discussions with potential investors and partners. If your concept doesn’t provide solutions within your analysis findings, must pivot or it will fail. If you are new to these concepts, you will notice how quickly the water is getting deeper than the wading pool it started out as - (Actually, it’s not water, it’s alphabet soup – FDA, USPTO, IDE, 510K, IRB, IACUC, and more). Experienced CEO/entrepreneurs will know how quickly a project can turn into an expensive time suck that they don’t have the time or inclination to manage. So whether you are experienced, or new in this business, now would be a good time to reach out to the experts at BizPush and MedSurgPI for a no-commitment exploratory discussion. Contact us! Further reading There are many publications (on line and hard copy) offering a wealth of data. Fortune Business Insights offers one such: https://www.fortunebusinessinsights.com/industry-reports/medical-devices-market-100085. While reports and publications may contain a vast amount of data that might be only loosely applicable to your project, they can be expensive enough to take a bite out of your seed funds, and still leave you with the necessity to do a lot of footwork and on the ground research. |

AuthorPeter Harris brings a career in medical devices with companies such as Hewlett-Packard and GE Medical, but has found equal challenges and rewards in working at the start-up level and as a self-employed Consultant. ArchivesCategories |

RSS Feed

RSS Feed